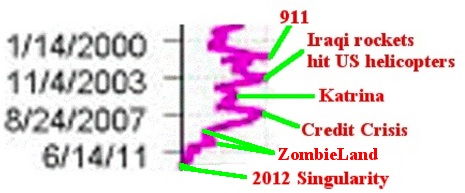

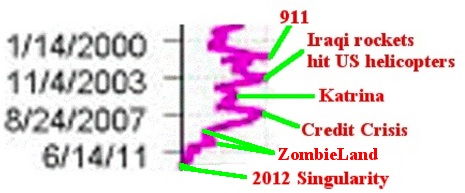

What does the TimeWave tell us about next 3 years, 2009 to 2012 ?

From now (April 2009) into 2010 is a nearly flat (or seemingly slightly rising) plateau that I call ZombieLand. In ZombieLand, Trillions of USA Dollars are fed to keep insolvent (but politically influential) financial institutions in an undead state - that is, not a living useful part of the Global Economy, but not officially recognized as being dead. To understand ZombieLand, you need to understand what is a Trillion USA Dollars. Glenn Beck (on his TV show) made a very good effort to show what is a Trillion USA Dollars. He said (I am paraphrasing): :

"... Here are $100 USA Dollars and $1 Million USA Dollars (It would fit in a suitcase):

Here are $1 Billion USA Dollars (It is about the size of a car) and $1 Trillion USA Dollars (It is about the size of a Thousand Cars in a big parking lot.)

...".

...".Another way to visualize the size of $1 Trillion USA Dollars is to realize that the population of the USA (around 300 Million people) is about 100 Million Families.

Since the population of the Earth is around 6 Billion, that would be almost $100,000 for every Person on Earth.

According to a 15 March 2009 huffingtonpost.com article by Arianna Huffington:

"... The battle lines over how to deal with the banking crisis have been drawn. On the one side are those who know what needs to be done. On the other are those who know what needs to be done -- but won't admit it. Because it is against their self-interest. Unlike the conflict over the stimulus package, this is not an ideological fight. This is a battle between the status quo and the future, between the interests of the financial/lobbying establishment and the public interest. What needs to be done is hard but straightforward. As Martin Wolf of the Financial Times sums it up: "Admit reality, restructure banks and, above all, slay zombie institutions at once." This tough love for bankers is being promoted by everyone from Nouriel Roubini, Paul Krugman, and Ann Pettifor to Niall Ferguson, the Wall Street Journal, and Milton Friedman's old partner, Anna Schwartz ... "They should not be recapitalizing firms that should be shut down," says Schwartz. "Firms that made wrong decisions should fail."... Tim Geithner ... is on the wrong side of the issue, more worried about the banking industry than the American people. Like Hank Paulson before him, Geithner appears more concerned about saving particular banks than saving the banking system. ... As Ann Pettifor puts it on HuffPost: "Much of Wall Street is effectively insolvent. It's not that these banks lack cash or capital -- it's just that they're never going to meet all their financial liabilities -- i.e. repay their debts. Ever." ...".

According to a 23 March 2009 democracynow.org interview of Paul Krugman:

"... "The Zombie Ideas Have Won" - Paul Krugman on $1 Trillion Geithner Plan to Buy Toxic Bank Assets ... Treasury Secretary Timothy Geithner is preparing to unveil a plan ... to purchase as much as $1 trillion in troubled mortgages and other assets from banks. ... The Obama administration has described the plan as a public-private partnership, but most of the actual money will be put up by the government. ... Paul Krugman: A zombie idea is ... a bad idea, but it just keeps on coming back. ... to ... have taxpayers go in and buy ... these toxic assets ... 85 percent of the money is going to be a loan from the government, which is a non-recourse loan ... this is not Geithner. Ultimately, the buck stops in the Oval Office. The question is, why is President Obama going with the soft side, the hope over analysis, on this stuff? ... the view still, apparently, dominant ... in this administration is that there's nothing really fundamentally wrong with the system. ... those people who we thought were so smart ... really are smart, and we want to keep them on the job. ... the Obama administration is still partying like it's 2006. ...".

According to a 22 April 2009 economictimes.indiatimes.com article by Swaminathan S. Anklesaria Alyar:

"... the Obama administration is prolonging the recession by avoiding surgery to remove dead wood from its financial sector. Some call this cowardice. Others, such as former IMF chief economist Simon Johnson, writing in The Atlantic, say Wall Street has captured the White House. ... Johnson says the US now resembles Russia, where business oligarchs and government officials protect each others' financial interests, at the expense of the economy. ... This ... highlights the priority given by the Obama administration to save the titans of Wall Street rather than end the recession quickly. ... Technically, the financial sector is comprehensively bust. It needs to recognise the losses, writing off trillions. ... The market solution would be to force insolvent banks into bankruptcy, with shareholders and creditors taking a huge hit ... Many titans of Wall Street will disappear ... the Obama administration refuses to contemplate this obvious solution. ... Wall Street has captured the White House, so nothing will be done to imperil the politico-financial network that rules the US. Robert Rubin and Hank Paulson, treasury secretaries of Clinton and Bush, were both from Goldman Sachs. Larry Summers, the current treasury secretary, earned millions as a hedge fund consultant. In a market economy, well-managed companies should be rewarded with profits, while mismanaged companies should go bust. This basic rule has been suspended almost entirely for the titans of Wall Street. ... Accounting norms have been tweaked to permit zombie banks to pretend they are alive and solvent....".

The Confucian I Ching (used by Terence McKenna in constructing the TimeWave) seems to be derived from Ancient African Mathematical Divination. Ron Eglash, in his book "African Fractals" (Rutgers 1999), said: "... fractal settlement patterns of Africa stand in sharp contrast to the Cartesian grids of Euro-American settlements. ... Euro-American cultures are organized by ... "top-down" organization. Precolonial African cultures included ... societies that are organized "bottom-up" rather than "top-down". ... most of the indigenous African societies were neither utterly anarchic, nor frozen in static order; rather they utilized an adaptive flexibility ... African traditions of decentralized decision making could ... be combined with new information technologies, creating new forms that combine democratic rule with collective information sharing ...".

Although some regard China as a top-down dictatorship, the true situation is quite different, as is exemplified by the Chinese Computer Hacker Community. According to a 23 April 2009 popsci.com article by Mara Hvistendahl: "... In the past two years, Chinese hackers have intercepted critical NASA files, breached the computer system in a sensitive Commerce Department bureau, and launched assaults on the Save Darfur Coalition, pro-Tibet groups and CNN. And those are just the attacks that have been publicly acknowledged. Were these initiated by the Chinese government? Who is doing this? ... It's hundreds of thousands of everyday civilians. ... This ... Hacker ... culture thrives on a viral, Internet-driven nationalism. ... China's Internet patriots, who call themselves "red hackers," may not be acting on direct behalf of their government, but the effect is much the same. ... The Red Hacker Alliance, often described in the Western press as a monolithic group, is in fact a loose association allowing disparate cells to coordinate their efforts. ... the largest unifying characteristic is nationalism. In a 2005 Hong Kong Sunday Morning Post article, a man identified as "the Godfather of hackers" explains, "Unlike our Western [hacker] counterparts, most of whom are individualists or anarchists, Chinese hackers tend to get more involved with politics because most of them are young, passionate, and patriotic." Nationalism is hip, and hackers -- who spearhead nationalist campaigns with just a laptop and an Internet connection -- are figures to revere. Henderson ... emphasizes that the relationship between citizen and state is fluid in China, and that the Chinese government tends not to prosecute hackers unless they attack within China. To Henderson, that lack of supervision is tacit approval, and it constitutes a de facto partnership between civilian hackers and the Chinese government. Jack Linchuan Qiu, a communications professor at the Chinese University of Hong Kong ... agrees. "Chinese hackerism is not the American 'hacktivism' that wants social change," he says. "It's actually very close to the state. The Chinese distinction between the private and public domains is very small." ...".